How to Add or Change Your Bank Account at Embark

One of the features of investing with Embark is the ability to electronically transfer funds from your bank checking account into your Embark account. Electronic ACH transfers are easy, safe, and cost-effective.

When linking a bank account, you should always link your checking account. It is not recommended that you link a savings account because these accounts typically limit the number of withdrawals you can make. Note that some banks may use the same account/routing number for checking and savings accounts. In these circumstances, our technology partner (Betterment) will default to withdrawing from and depositing to your checking account. For security purposes, you may only have one active checking account at a time linked to your investment account at Embark.

How to Link a Bank Account

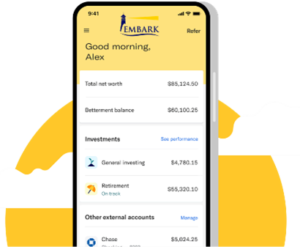

If you have not already done so, first you need to open an account at Embark. For clients that have already opened an account, login to your account by navigating to the Sign In tab from the menu bar on our website at www.Embark-Invest.com.

Once you have set up your account and you are logged in, you will see a pop-up block on your home screen prompting you to add your bank account. Simply follow the prompts and add your bank account. If, however, the pop-up block does not show up, navigate to the settings page located in the bottom left of your screen. Once on the Settings page, click the “Bank accounts” tab in the menu bar and you will see the button to add your bank account. You will be able to search for your bank by name. If the option to link your account elctronically is available, you can instantly link your bank account by providing your username and password for that institution.

Your bank may require you to complete additional two-step verification, which is an additional layer of security, before Embark can gain access to the account. If so, you will be prompted with verification questions or a code, generated when you provide your login credentials. This code is provided by your other financial institution via email, text, or telephone call.

Linking Manually:

If you are not presented with the option to link electronically, you can manually link your bank account with your account and routing number.

To add your bank account manually, log in on a web browser and select “settings” in the bottom left of your screen, then “Bank accounts”. You will then see the option to add a bank account. Select the “add by account and routing number” option rather than by searching for your bank’s name.

Note that linking manually involves Betterment sending two micro-deposits (each under $1.00) to your bank, which you must then verify inside of your Embark account. Due to standard ACH timelines, this process generally takes 1-2 business days.

Changing Your Bank Account

On a web browser: Select “Settings” from the menu, then “Bank accounts” and then “change bank”. Betterment will send you a code in order to authenticate your account and then follow the prompts to change your bank.

On the mobile app: After logging in, tap the three bars on the top left. Select “settings” and then select “Funding Accounts”. Click on the three dots to the right of the account you want to change and you’ll see the option to change your funding account.

Also note that Embark staff are unable to change your bank’s settings.

Have questions?

If you have any questions about holdings in your account or one of our models, or perhaps have another question about our services, you can contact us directly at 920.785.6012 or email us at [email protected]. Betterment maintains a support line you can also call for help with navigation, linking your accounts or other site functionality. You can call the Betterment for Advisers support line at 800.400.1571.

Last updated January 9, 2023

Disclosures: Content contained herein is presented is for informational and educational purposes only and is not intended as an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies, nor shall it be construed to be the provision of individualized investment, tax, or legal advice.

Embark is a digital investment service advised by ETF Model Solutions, LLC. Investments recommended by Embark involve risk and will fluctuate in value. Unless otherwise stated, investments are not insured or guaranteed. May lose money. Embark utilizes the platform and technology services of Betterment LLC, an SEC Registered Investment Adviser. Betterment provides the wrap fee program that assists us in providing our services to you. Custody and trading services for the program are provided by Betterment Securities, an SEC registered broker-dealer and member FINRA/SIPC.

Embark’s services are specific to the investment goals that you identify. We do not provide comprehensive financial or tax planning. Our Advisory services rely upon an algorithm designed and maintained by Betterment to assist us in determining our portfolio recommendations. Unless you directly consult with Embark Advisory personnel, the algorithm is the sole basis of the advice. You should not rely solely on the Betterment advice algorithm’s recommendation to make your investment decisions. Embark strongly advises all Clients to speak directly with an Embark IAR prior to making any investment decisions.

All tools and content on the Betterment, LLC website, are designed, created, and maintained by Betterment. Certain functionality, tax-coordinated portfolios and links to investment philosophy, research, educational materials, and FAQs apply solely to betterment’s 2-dimensional portfolios and may not apply to Embark’s 3-dimensional investment recommendations.

Existing Embark clients are reminded to login and update personal information whenever their goals or personal financial circumstances change. Clients should also confirm that their current goal allocation is aligned with the recommended target allocation provided for each goal. Clients with questions regarding their account, personal financial circumstances, goals, or an investment allocation with respect to our service should contact us via email or telephone.

Prospective clients contemplating opening an account with Embark are advised to read Embark’s Form ADV Brochure, Part 2A for important disclosures about our services, business practices, the costs, and risks of investing, and other important considerations prior to opening their account. You can access the most recent version of our Form ADV via a link on our website.

ETF Model Solutions, LLC. is registered as an investment adviser with the SEC. Registration does not imply a certain level of skill or training. If you have any questions about our professional services, please call us at 920.785.6012 or email [email protected]