Goals-Based Investing with Embark

Goals-based investing is a more “client-centric” process that is focused on measuring progress towards your goals rather than a focus on generating the highest possible return or “beating the market”. The process requires investor involvement because you determine your desired tangible outcome and then take the required actions necessary (how much you need to start saving and investing today) to help you achieve your goal. Tracking progress towards your goal and making adaptive changes based on market behavior or your personal financial circumstances is also a critical part of the process. This involvement helps set your expectations about what behaviors are necessary both now and along the way to help reach your desired outcome. By having a determined goal to which you have a tangible outcome, you are more likely to work towards success than you would otherwise if you were just accumulating savings.

How Does Goals-Based Investing Work?

There are four main aspects to goals-based investing:

- Defining your goal or goals (i.e., what are you saving and investing for?).

- Determine what savings or income are available to invest.

- Select appropriate strategy to help attain the goal.

- Tracking progress and adapting behaviors to help remain on track towards success.

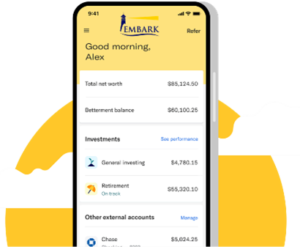

Setting Goals with Embark

Embark uses a technology platform provided by Betterment for Advisers to help us serve our clients. When you set up your investing goal at Embark, you will primarily obtain two pieces of advice- a suggested allocation based on your time horizon, and the second is how much you need to deposit or invest now, or on a recurring basis that will help you reach that goal. You can always make changes to the allocation and the amount you invest. The platform is simply providing you with recommendations- you are making the ultimate decisions if an allocation is right for you.

Opening Your Account and Setting New Goals

After you have opened your general account, you can create a new goal from the Summary page. Simply click on “Add Account” and you will have the option to select a goal or account type to start. There are six different “goal types” to choose from (Major Purchase, Safety Net, Retirement, Education, General Investing and Smart Saver) and six different “account types” to choose from (Individual Taxable, Joint Taxable, Roth IRA, Traditional IRA, SEP IRA and Trust). Keep in mind that goals and accounts are the same thing, Betterment is attempting to help define important goals you may be interested in saving for, thus they offer the ability to open an account “by goal type”.

Remember, you can set up one or more of these goals. When setting the goal, the system will generally request the amount and time frame of your goal. For any existing goal, you can change your goal type in the Advice tab of your account. You will see an option that reads “Manage Goal” that leads you to the option to update your goal type.

Projected outcomes on the Advice tab on the Betterment LLC website are based upon Betterment’s capital market assumptions applied to each security within the Custom Portfolio1 Embark uses Betterment’s Custom Portfolio functionality to delivery our solutions to you. Custom Portfolios operate differently on the Betterment Platform than standard portfolios and Betterment’s Platform does not fully explain these differences. Therefore, you should use the platform information solely as a guide to assist with your investment decision-making process and not as a recommendation. You Please contact an Embark Investment Advisor Representative (“IAR”) whenever you want to:

- Open a new account

- Create a new goal

- Make a change to an existing goal.

Our Embark IARs will ask you questions to help understand your goals and risk tolerance and assist with making the required changes to invest your account in the Custom Portfolio best suited to help you achieve your goals.

- Your goal and a recommended portfolio please give us a call and we will be glad to help.

1 Custom Portfolios are Advisor-designed custom portfolios that Embark constructs and makes available to our Clients on the Betterment Platform.

Have Questions?

If you have any questions about holdings in your account or one of our models, or perhaps have another question about our services, you can contact us directly at 920.785.6012 or email us at [email protected]. Betterment maintains a support line you can also call for help with navigation, linking your accounts or other site functionality. You can call the Betterment for Advisers support line at 800.400.1571.

Last updated January 9, 2023

Disclosures: Content contained herein is presented is for informational and educational purposes only and is not intended as an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies, nor shall it be construed to be the provision of individualized investment, tax, or legal advice.

Embark is a digital investment service advised by ETF Model Solutions, LLC. Investments recommended by Embark involve risk and will fluctuate in value. Unless otherwise stated, investments are not insured or guaranteed. May lose money. Embark utilizes the platform and technology services of Betterment LLC, an SEC Registered Investment Adviser. Betterment provides the wrap fee program that assists us in providing our services to you. Custody and trading services for the program are provided by Betterment Securities, an SEC registered broker-dealer and member FINRA/SIPC.

Embark’s services are specific to the investment goals that you identify. We do not provide comprehensive financial or tax planning. Our Advisory services rely upon an algorithm designed and maintained by Betterment to assist us in determining our portfolio recommendations. Unless you directly consult with Embark Advisory personnel, the algorithm is the sole basis of the advice. You should not rely solely on the Betterment advice algorithm’s recommendation to make your investment decisions. Embark strongly advises all Clients to speak directly with an Embark IAR prior to making any investment decisions.

All tools and content on the Betterment, LLC website, are designed, created, and maintained by Betterment. Certain functionality, tax-coordinated portfolios and links to investment philosophy, research, educational materials, and FAQs apply solely to betterment’s 2-dimensional portfolios and may not apply to Embark’s 3-dimensional investment recommendations.

Existing Embark clients are reminded to login and update personal information whenever their goals or personal financial circumstances change. Clients should also confirm that their current goal allocation is aligned with the recommended target allocation provided for each goal. Clients with questions regarding their account, personal financial circumstances, goals, or an investment allocation with respect to our service should contact us via email or telephone.

Prospective clients contemplating opening an account with Embark are advised to read Embark’s Form ADV Brochure, Part 2A for important disclosures about our services, business practices, the costs, and risks of investing, and other important considerations prior to opening their account. You can access the most recent version of our Form ADV via a link on our website.

ETF Model Solutions, LLC. is registered as an investment adviser with the SEC. Registration does not imply a certain level of skill or training. If you have any questions about our professional services, please call us at 920.785.6012 or email [email protected]