How to use the Betterment Checking Account

What is the Betterment Checking Account?

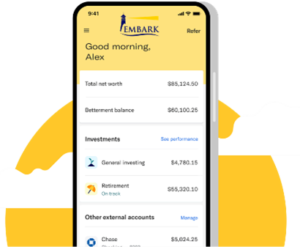

Betterment Checking is a mobile-first checking account designed for simplicity, transparency, and convenience. It comes with no monthly fees, no minimum balance requirements, and no overdraft fees. Betterment currently will fully reimburse you for foreign fees and ATM fees worldwide. Reimbursement policies are subject to change and may have limitations. For current terms, visit Betterment Checking. Betterment Checking allows you to deposit checks electronically, establish direct deposits, and pay bills—all from the Betterment app or website.

The Betterment Visa® Debit Card is included and can be used wherever Visa is accepted, including tap-to-pay, Apple/Google Pay, or paper checks. Betterment Checking is offered in partnership with nbkc bank, Member FDIC, which provides FDIC insurance on balances up to $250,000 per depositor. Betterment Checking is designed to simplify everyday banking with a modern digital interface and convenient access features.

How to set up a Betterment Checking Account

To set up a Checking account, go to www.Embark-Invest.com and log in to your account. On the left side of the screen under “Home” select “Open new account”, then “Checking”. You will need a U.S. driver’s license or U.S. Passport, and your phone camera to be able to continue. Scan the QR code on your phone or enter in your phone number to receive a text. Complete the verification steps on your phone, submitting a photo of your identification, and a photo of yourself. Once complete, back on your computer, your browser should automatically refresh, prompt you to continue. After continuing, choose to open an individual or a joint account. You will be prompted to read the terms and conditions documents, once you have read and agree to the terms, click “Accept and continue”. You will be required to answer questions pertaining to your residential address and employment status. Finally, select how you want to fund your checking account from the drop-down menu. Betterment will then verify your information, and your account will be created.

After your account is activated, Betterment will automatically send a Visa debit card to your address. In the meantime, from the Overview tab in your Checking account you can set up direct deposit, or further fund your account with a deposit or transfer. Once you receive your card you can activate it by going to your Checking account and clicking “Activate card” and entering the last four digits of the card. You can also set a pin for ATM use during this step. Once activated, your Betterment Checking account and debit card are all set to go.

Have questions?

If you have any questions about holdings in your account or one of our models, or perhaps have another question about our services, you can contact us directly at 920.785.6012 or email us at clientservices@embark-invest.com. Betterment maintains a support line you can also call for help with navigation, linking your accounts or other site functionality. You can call the Betterment for Advisers support line at 800.400.1571.

Last updated June 3, 2025

Disclosures: Content contained herein is presented for informational and educational purposes only and is not intended as an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies, nor shall it be construed to be the provision of individualized investment, tax, or legal advice.

Cash management, and other account services, including savings accounts,

checking accounts, debit cards and other services may be offered by Betterment

to Embark Clients. In these instances, Embark does not provide these services

and does not receive any compensation nor shared fee revenue based on Client

deposits in Betterment’s cash management or checking programs. Clients are not

obligated to accept these services and are solely responsible for their

decision to accept or decline these services. Clients that accept these

services should review the Betterment Wrap Fee Brochure; a copy of the most

recent version can be accessed on the SEC’s IAPD website at: https://www.adviserinfo.sec.gov/Firm/149117 (select “Firm” and type “Betterment LLC” in the search bar at the

top of the page. Then click “Get Details” and Select “Part 2 Brochures”).

Embark is a digital investment service advised by ETF Model Solutions, LLC. Investments recommended by Embark involve risk and will fluctuate in value. Unless otherwise stated, investments are not insured or guaranteed. May lose money. Embark utilizes the platform and technology services of Betterment LLC, an SEC Registered Investment Adviser. Betterment provides the wrap fee program that assists us in providing our services to you. Custody and trading services for the program are provided by Betterment Securities, an SEC registered broker-dealer and member FINRA/SIPC.

Embark’s services are specific to the investment goals that you identify. We do not provide comprehensive financial or tax planning. Our Advisory services rely upon an algorithm designed and maintained by Betterment to assist us in determining our portfolio recommendations. Unless you directly consult with Embark Advisory personnel, the algorithm is the sole basis of the advice. You should not rely solely on the Betterment advice algorithm’s recommendation to make your investment decisions. Embark strongly advises all Clients to speak directly with an Embark IAR prior to making any investment decisions.

All tools and content on the Betterment, LLC website, are designed, created, and maintained by Betterment. Certain functionality, tax-coordinated portfolios and links to investment philosophy, research, educational materials, and FAQs apply solely to betterment’s 2-dimensional portfolios and may not apply to Embark’s 3-dimensional investment recommendations.

Existing Embark clients are reminded to login and update personal information and contact an Embark IAR whenever their goals or personal financial circumstances change. Clients should also confirm that their current goal allocation is aligned with the recommended target allocation provided for each goal. Clients with questions regarding their account, personal financial circumstances, goals, or an investment allocation with respect to our service should contact us via email or telephone.

Prospective clients contemplating opening an account with Embark are advised to read Embark’s Form ADV Brochure, Part 2A for important disclosures about our services, business practices, the costs, and risks of investing, and other important considerations prior to opening their account. You can access the most recent version of our Form ADV via a link on our website.

ETF Model Solutions, LLC. is registered as an investment adviser with the SEC. Registration does not imply a certain level of skill or training. If you have any questions about our professional services, please call us at 920.785.6012 or email clientservices@Embark-Invest.com